Click to zoom

Click to zoom

How Nvidia Became the First $5 Trillion Company

Nvidia just crossed a threshold that, if you’d told me a few years back, would have sounded like a punchline — the first publicly traded company to top a $5 trillion market cap. Sure, the immediate catalysts were headline-grabbing: plans for seven government supercomputers and disclosures of roughly $500 billion in AI chip orders. But what really made markets sit up was how perfectly those announcements fit a bigger story — compute scarcity in the age of generative AI.

Having watched multiple hardware cycles up close, I’m convinced this isn’t vanity. A $5 trillion valuation is a signal. Investors are treating specialized AI chips and AI compute infrastructure as core national and commercial plumbing, not a peripheral gadget. That is seismic. Think of the reclassification that once turned networking, storage, and cloud into utilities; Nvidia just rode a similar transition from a graphics-card vendor to critical compute infrastructure. That’s a very different business model, and the market is pricing it as such.

Why this milestone matters

Numbers on a screen can feel abstract, so here’s the practical bit. Nvidia’s market value now rivals nations’ entire stock markets — briefly even exceeding the aggregate crypto market. But under the headline is a simpler truth: firms training large language models and offering AI-as-a-service need enormous, high-throughput compute. That demand doesn’t disappear overnight. Nvidia’s H100 and the newer Blackwell chips became the path of least resistance for many architects. And in systems design, the path of least resistance often becomes the standard.

What grabbed me is the lock-in. The moat isn’t just a single product; it’s the ecosystem lock-in. Data centers optimize software stacks, toolchains, and operational playbooks around Nvidia silicon. Once you’ve tuned your model libraries, drivers, and CI pipelines for that stack, the switching costs — engineering time, validation cycles, performance tuning — are painful. It’s sticky. Very sticky.

Key drivers behind the rally

- Government and enterprise orders: The seven supercomputers and the headline ~$500B pipeline aren’t just PR; they imply multi-year, high-margin contracts. Governments and hyperscalers buy scale, reliability, and roadmaps — they don’t casually experiment at the bleeding edge without proven suppliers.

- AI product wave: Since ChatGPT’s breakout in 2022, both training and inference demand exploded. That’s physics: larger models, more parameters, more matrix multiplies — and specialized accelerators tend to win those battles.

- Investor psychology: Momentum and FOMO are tangible forces. When Nvidia becomes an easy shorthand for ‘AI exposure,’ capital flows accelerate and valuation multiples expand. It’s a feedback loop — sometimes useful, sometimes treacherous.

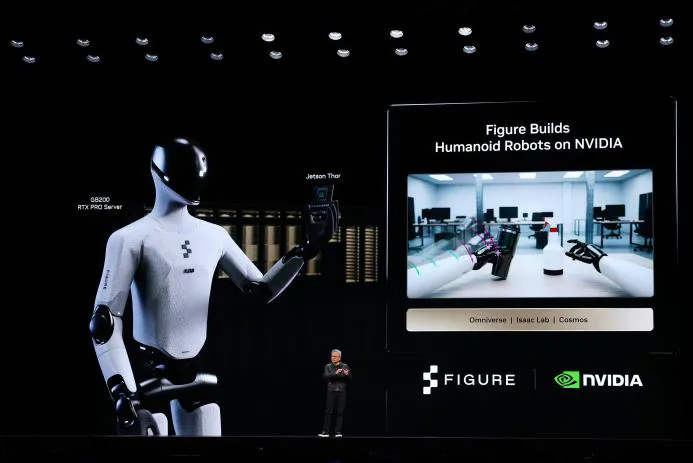

What Nvidia announced: Supercomputers and chip orders

At the developer conference that preceded the market leap, Jensen Huang outlined aggressive expansion: seven new supercomputers for U.S. agencies and a reported half-trillion in AI chip demand. If a meaningful slice of that pipeline converts, we’re talking recurring, somewhat predictable revenue over many years. Cloud providers, national labs, telcos, and research institutions will renew capacity as models grow — that's the thesis.

One complication: export controls. The most advanced parts — Blackwell-class devices — are regulated. That elevates Nvidia from a mere vendor to a geopolitical lever. When chips get wrapped up in national security policy, sales cycles and supply chains become entangled with diplomacy and trade. Not your typical procurement headache — but then again, tech seldom stays purely commercial for long.

Geopolitics: chips as leverage

If you live in this world, you’ve noticed semiconductor topics turning up in summit-room conversations. Washington’s export controls aim to slow the transfer of advanced AI chips. That policy cuts both ways: it narrows addressable foreign markets for suppliers like Nvidia, but it also makes them strategically vital at home — think preferential procurement, subsidies, or incentives to keep critical capacity onshore.

There’s real risk: policymakers can tighten or loosen access windows quickly. But there’s opportunity too: a company deemed strategically important may win privileged government contracts and long-term procurement commitments. The geopolitics piece isn’t background noise — it’ll shape revenue corridors for years.

Leadership, wealth and market influence

Jensen Huang, who co-founded Nvidia in 1993, has seen his stake balloon into one of the tech world’s great wealth stories. That personal headline matters — but more important is the strategic posture he’s shepherded: a pivot from gaming GPUs to AI compute and a deliberate cultivation of developer and partner ecosystems around that pivot.

This is classic repositioning executed well: find a high-margin, fast-growing niche; build technical credibility; then scale globally. It wasn’t luck. It was deliberate — and it’s paid off spectacularly.

Are valuations overheating?

Time for the skeptical note. Yes, the gains are concentrated. A handful of firms — Nvidia chief among them — are driving major index performance, and that creates fragility. Two immediate risks stand out:

- Concentration risk: When one or two companies dominate returns, market moves become binary. A stumble at Nvidia can ripple through ETFs, funds, and risk models.

- Profitability timeline: Right now, markets reward capacity expansion and forward-looking bookings. But if sentiment flips toward immediate cash flows, multiples could compress. Investors are paying today for future, often deferred, monetization of compute capacity.

As many observers note, capacity expansion is prized now — but preferences can pivot. Investors eventually get picky. They always do.

Competition and long-term outlook

There are hungry competitors: AMD is pushing, startups iterate on domain-specific accelerators, and hyperscalers prototype custom silicon. Still, the practical reality of switching is enormous. Replacing an incumbent GPU fleet isn’t like swapping a cloud region for another. It’s platform work — drivers, compiler stacks, optimized model libraries, and ops playbooks all tuned to one vendor’s silicon.

Imagine a mid-sized cloud provider trying to retool its GPU fleet to a competitor’s architecture. The cost isn’t just the cards — it’s months of engineering, validation cycles, potential performance regressions during the transition, and customer friction. That inertia gives Nvidia meaningful runway.

Takeaways for investors and industry leaders

- Nvidia is more than a chipmaker: It’s a platform play — hardware, software, partnerships, and developer mindshare. Treat it like a platform, not just a component vendor.

- Watch geopolitics: Export controls and trade policy will materially affect addressable markets. Policy risk is business risk now.

- Expect competition: Incumbency is strong, but rivalry will erode margins over time. Innovation cycles are accelerating.

- Valuation vigilance: Momentum can carry prices far, but long-term investors should focus on cash flows, contract conversion rates, and the proportion of the $500B pipeline that actually turns into bookings.

Bottom line: Nvidia’s leap to $5 trillion is emblematic of the AI era’s scale and a reminder that tech markets are messy mixes of innovation, policy, and investor psychology. I think it marks a structural shift in computing — but it also raises stakes for regulators, competitors, and long-horizon investors. Watch the contracts. Watch the policy. And watch for the point where narrative meets numbers.

Further reading

For more on AI chips and market implications, I like the deep dives from TECHnalysis Research and the financial coverage in outlets like Forbes. Learn more about semiconductor industry dynamics in our article Intel\'s Foundry Business Takes Center Stage Amid Financial Recovery. If you’re asking: “How did Nvidia become a $5 trillion company?” or “Will Nvidia’s $500B orders convert to revenue?” — those pieces are a solid next step.

Thanks for reading!

If you found this article helpful, share it with others