Click to zoom

Click to zoom

Intel's Impressive Financial Rebound

Intel quietly — and then not so quietly — surprised a lot of people this quarter. What hit me was how fast a string of pragmatic moves showed up in the numbers: Q3 results that beat Wall Street's conservative takes, funded by aggressive cost cuts and smart capital plays. From where I sit, rebounds like this rarely come from one hero product or a single PR moment. They’re patchworks — disciplined expense management, a few bold financial partners, and yeah, some strategic pruning.

The quarter delivered roughly $4.1 billion in net income. That matters because it follows a run of losses and signals a shift from defense to offense. The cost-reduction program — layoffs, tighter discretionary spending, trimming underperforming projects — isn’t glamorous. But it bought breathing room. And that breathing room lets Intel lean into bigger, multi-year bets rather than just firefighting the next quarter. The message to investors was blunt: management will make hard choices.

Strategic Investments Fueling Intel's Revival

Here’s the plot twist: Intel didn’t only tighten the belt — it also opened the door to deep-pocketed partners. Over the quarter the balance sheet swelled by roughly $20 billion. SoftBank put in about $2 billion in August. Nvidia committed $5 billion in September for an AI chip collaboration. And the U.S. government effectively took a near-10% stake. Those aren’t small votes of confidence.

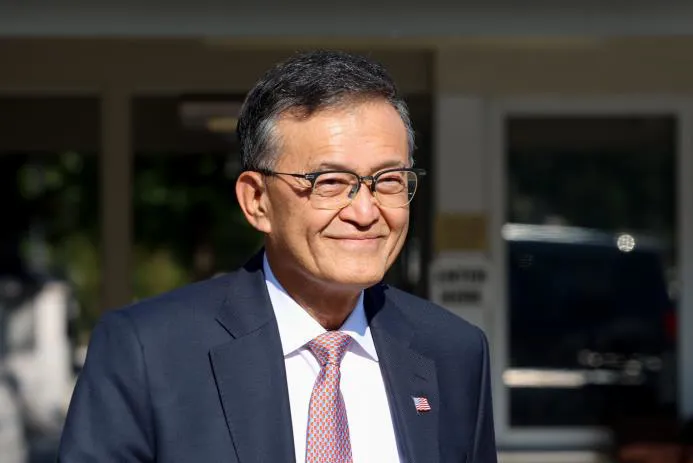

SoftBank’s capital is the kind of patient-ish funding you see when outsiders buy the turnaround thesis. Nvidia’s check is strategic signalling — two rivals (in some areas) aligning over AI silicon. The government stake is politically loaded but stabilizing: it anchors Intel as a domestic advanced node manufacturer. As CEO Lip-Bu Tan said on the call, a stronger balance sheet gives operational latitude. Translation: they can invest where it matters without getting spooked by quarterly noise.

Divestitures Bolstering Financial Health

There was also tidy housekeeping. Intel monetized an Altera stake for $5.2 billion and moved to sell Mobileye — not panic selling, but strategic reallocation. I’ve seen this playbook: sell peripheral bets to concentrate capital on core differentiated capabilities. In Intel’s case that’s chip fabs, R&D, and the foundry ambitions everyone’s watching.

Revenue rose about $800 million to $13.7 billion for the quarter. Practically, that’s lower burn, smarter balance-sheet engineering, and one-time divestiture gains — culminating in a $4.1 billion profit versus a $16.6 billion loss a year earlier. Not magic. Just a lot of small, unpleasant decisions adding up.

Challenges and Prospects for Intel's foundry business

If you want to know whether this rebound sticks, watch the foundry business. That division is my north star — where capital intensity, customer relationships, and execution risk collide. Intel has cut headcount there; hard to swallow, but sometimes necessary to refocus scarce engineering talent on high-payoff problems.

The political angle complicates things: the U.S. government's investment comes with strings. The deal ties future payouts and potential penalties to Intel maintaining a foundry presence domestically for the next five years. In plain terms: Intel can’t just walk away. That’s an obligation — and an advantage. Obligations force discipline, and a deep-pocketed sponsor wants a domestic semiconductor supply chain. It’s messy, but useful.

CEO Tan insists the foundry is primed to capture rising chip demand — and I believe him, sort of. Intel brings pedigree in advanced node manufacturing and a history of massive capex projects. Still, building a world-class contract foundry is about more than cleanrooms and EUV scanners. You need consistent EUV and wafer yields, predictable timelines, and a pricing model that makes sense when customers compare you to TSMC or Samsung. That’s the hard part.

I’ve sat through more vendor qualification cycles than I care to admit. Customers are unforgiving. One missed delivery or a funky lot, and you’re back at square one. So yes — the balance sheet, SoftBank and Nvidia checks, and the government stake are necessary. They’re not sufficient. The trust equation is fragile; vendor qualification and customer onboarding are the day-to-day grind.

Still, Intel is doing the outward work: courting prospective foundry customers, promising a timeline to scale, and leaning on its brand legacy. This isn’t a sprint — it’s a multi-year rebuild. But with additional capital, a sharper cost base, and regulatory backing, Intel has runway. Will they pull it off? My read: better odds than a year ago, but plenty of execution risk. I’ll be watching yields, customer wins, and how they balance pricing pressure with margin recovery.

In short: this quarter felt like the moment a comeback became credible rather than wishful thinking. It’s satisfying to see a giant wake up and take the hard steps. But as any industry veteran will tell you, the next phase is harder — winning and keeping customers at scale. That, more than a single quarter’s profit, will determine whether Intel’s foundry revival endures.

Quick FAQ (what people also search)

- What does Nvidia's $5B deal with Intel mean? — Strategic AI partnership and signal that large customers will collaborate on chip design and manufacturing.

- How much did SoftBank invest in Intel? — About $2 billion, a vote of confidence in the turnaround thesis.

- Does the U.S. government now own part of Intel? — It took a near-10% economic stake, with conditions tied to domestic manufacturing.

- Can Intel compete with TSMC in chip manufacturing? — Possible, but it requires consistent yields, competitive pricing, and proven timelines versus TSMC and Samsung.

- Why sell Altera and Mobileye? — To free capital for fabs, R&D and building foundry capacity — classic capital allocation and divestitures strategy.

- How will Intel improve wafer yields and timelines? — Focused R&D, prioritized capex, tight fab capacity expansion plans, and vendor-grade process engineering. Still, that’s execution-heavy work.

- Is Intel's turnaround sustainable after Q3 2025? — Promising, given new capital and cost discipline — but sustainability hinges on foundry customer wins and execution.

- When will Intel's fabs scale to enterprise foundry customers? — Timeline cues came from management, but the market should expect a multi-year ramp, not months.

Thanks for reading!

If you found this article helpful, share it with others